Dividends are payouts from companies that share their profits with their investors. They offer a regular source of income that can increase over time. This makes them particularly attractive for long-term investments. Even a small dividend yield can result in impressive returns after many years. Dividends can offer protection against market volatility, another reason that investors include these stocks in their portfolios.

Top Strong Buy Dividend Stocks

Using the TipRanks Dividend Calendar, we searched for top stocks with an ex-dividend date in November 2021. Investors need to own the stock by the ex-dividend date to receive the next payout. We focused on top dividend stocks with a Strong Buy analyst rating consensus and at least 5% yield. We found five top stocks that match these criteria. Three out of the five stocks have an “Outperform” Smart Score, according to our data-driven stock score.

OneMain Financial (OMF)

Dividend yield: 17.79%

Ex-dividend date: November 1

Payout ratio: 69.59%

Payout date: November 9

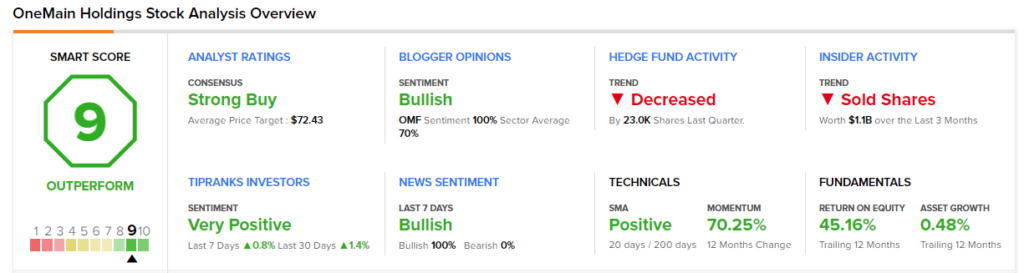

OneMain is a financial services company. Its main business is to provide personal loans and optional insurance products. The company offers an extremely attractive 17.79% dividend which it pays quarterly. In addition to its Strong Buy analyst rating consensus, the stock has a price target which indicates a 30.58% upside over the next 12 months. While overall hedge funds sold OMF shares in the last reported quarter, five managers increased their holdings, while four reduced. Company insiders are mixed, with both informative buy and sell transactions in the past 3 months. The stock has an Outperform Smart Score of 9 out of 10 which also reflects positive news sentiment and the recent transactions of individual investors with a TipRanks Smart Portfolio.

Energy Transfer (ET)

Dividend yield: 6.09%

Ex-dividend date: November 4

Payout ratio: 46.41%

Payout date: November 19

Energy Transfer owns and operates energy assets and provides natural gas pipeline transportation and transmission services. Its current price target of $14.25 indicates 44.52% upside potential. All four analysts who rated the stock in the past three months, gave it a Buy rating. It’s not just analysts who are Bullish. The company’s insiders seem extremely optimistic, with eight informative buy trades reported by five different insiders to the SEC in the past three months. Interestingly, when looking at all TipRanks investors, there has been a 1.2% drop in the number of portfolios holding ET in the past month. However, when you only look at the best performers, you see a 6.6% increase in the number of portfolios holding Energy Transfer. The stock has a Smart Score of 9.

Hercules Capital (HTGC)

Dividend yield: 8.48%

Ex-dividend date: November 9

Payout ratio: 111.88%

Payout date: November 17

Hercules Capital is a specialty finance company that provides senior secured loans to high-growth, innovative venture capital-backed companies. The stock’s $18.83 price target suggests a 7.29% upside potential. Hercules Capital also has an Outperform Smart Score of 10, reflecting positive news sentiment and blogger opinion.

Full story on TipRanks.com

Leave a Comment