The stock market is getting crushed, and we think it’s time to start considering the fact that the U.S. economy — only two years into its current expansion — may be headed for a recession by mid-2022…

That may sound scary. But it shouldn’t be scary, for three big reasons.

- We still think the odds of a recession are below 10%. That’s higher than we normally project, but still low in absolute terms.

- History suggests that — even if we do enter a recession — stocks may not fall that much farther from current levels.

- Recessionary periods and bear markets create once-in-a-decade buying opportunities in the stock market.

In other words, while recession risks are rising and stocks are falling, we are actually growing very bullish on a particular group of stocks in the market right now.

Crises have historically created opportunities. This time is no different. And the opportunities we’re seeing right now are potentially life-changing ones.

So, don’t freak out. Don’t run for cover…

The best thing you can do amid the current market crash is hunker down in a particular group of stocks that will soar once this crash — like every crash before it — passes.

Pay Attention to the Yield Curve

There is some spooky data out there which implies that a big economic slowdown — or worse — may be on the horizon.

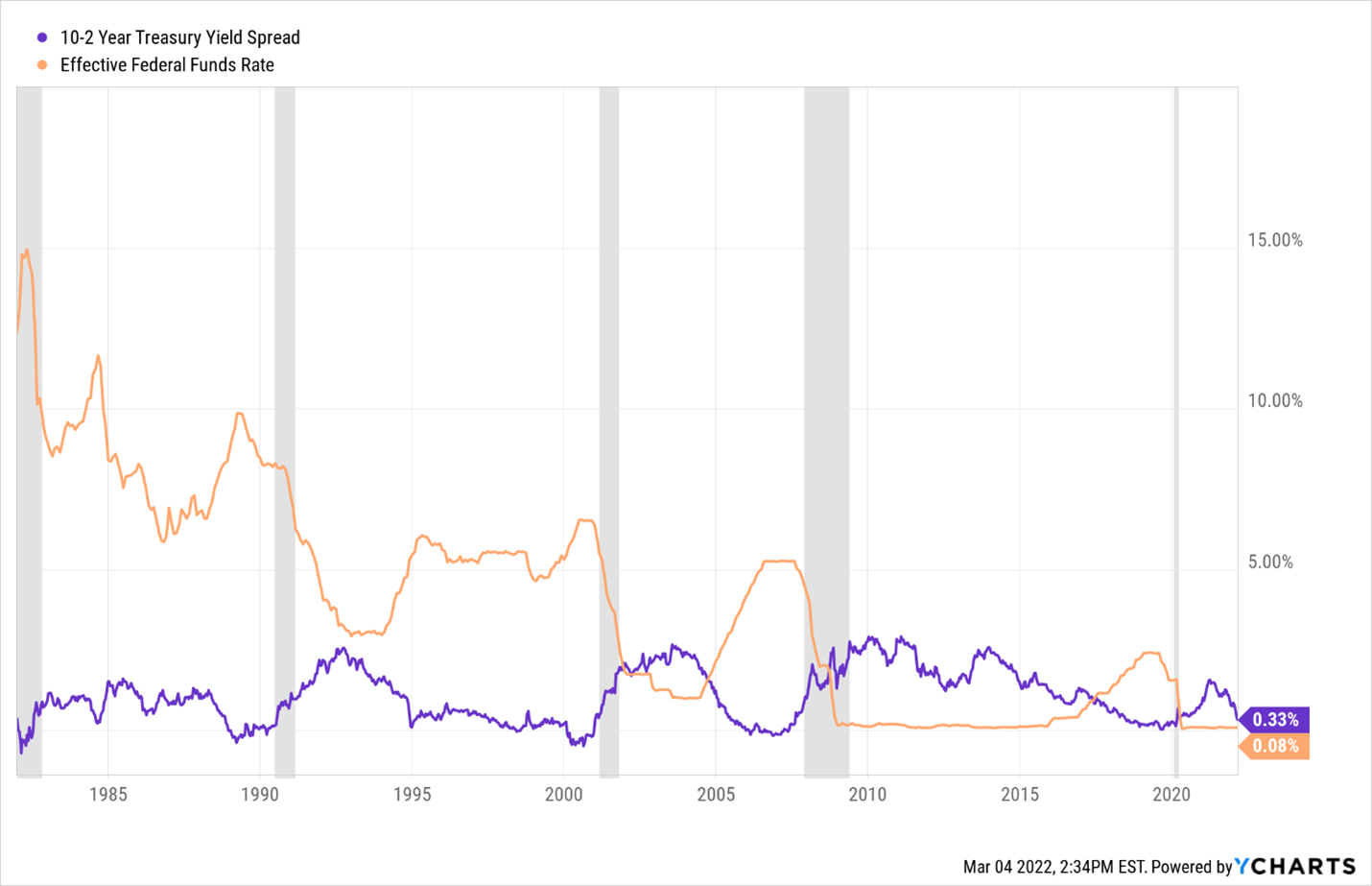

Perhaps the most important of these data-points is the spread between the 10-year and 2-year Treasury yields. It has been shrinking rapidly over the past few months, and last Friday, that spread broke below 30 basis points. As of this writing, the 10-year Treasury yield is only 25 basis points above the 2-year Treasury yield.

Recall that a flattening yield curve is the bond market saying that an economic slowdown is coming, while a yield curve inversion has preceded every economic recession since 1980.

What we’re seeing right now is a rapid flattening of the yield curve to below 30 basis points — a bearish dynamic that has happened only six times since 1982.

Four of those six occurrences were followed by a yield curve inversion within 12 months, and those inversions subsequently spilled into recessions. Two of those six occurrences were not followed by a yield curve inversion (August 1984 and December 1994). Both of those times, an inversion was averted by the Fed cutting rates — something they cannot do this time around because rates are at zero.

Indeed, instead of cutting rates into this rapid flattening, the Federal Reserve is projected to hike rates. And such an unprecedented action is expected to happen alongside a war in Europe and decades-high inflation readings. That’s not a bullish setup.

Altogether, while we still believe a recession can and will be averted by a dovish pivot from the Fed as well as easing geopolitical tensions in Europe, we do believe the data is clearly saying that recession risks are rising.

Sounds scary but it’s not.

How Much Farther Will Stocks Fall?

You may think that recessions and bear markets go hand-in-hand. But they don’t. In fact, “normal” recessions don’t lead to bear markets.

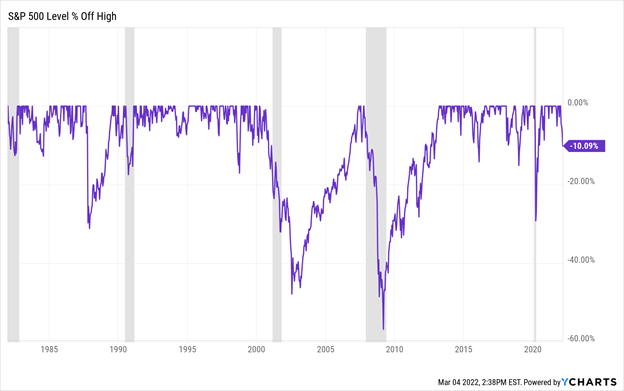

In the early 1980s, a U.S. economic recession led to just a 15% drawdown in stocks. The early 1990s recession similarly led to just an 18% drawdown in stocks.

Sure, the early 2000s recessions resulted in a 40% stock market collapse, while the 2008 recession sunk stocks by 50%.

But this is not that.

In 2000, we suffered from gross overvaluation. The S&P 500 was trading at 26X forward earnings, with a 10-Year Treasury yield above 5%. Today, the market is trading at 19X forward earnings, with a 10-Year Treasury yield below 2%. Today’s market valuation is significantly lower both in absolute and relative terms compared to what we saw in 2000.

Meanwhile, in 2008, the entire U.S. financial system was on the verge of collapse. We don’t have that today. Balance sheets across banks, corporations, and households are cash-heavy and very strong. Interest rates are very low. We do not have another 2008 on the horizon.

So, in the grand scheme of things, if we do head into a recession in 2022/23, it will likely be a run-of-the-mill recession – like the early 1980s and early 1990s – in which stocks dropped less than 20%.

The S&P 500 is already more than 10% off recent highs. Therefore, history says that even if we enter a recession, stocks maybe only fall another 5% to 10% from current levels. That’s not much further downside, and it means that now may be the time to actually start buying the dip in stocks.

Growth Stocks Win Once the Crash Passes

At the top of this note, we wrote that we’re very bullish on a certain group of stocks at the current moment. That group of stocks is hypergrowth tech stocks.

I know. That may sound counterintuitive. But follow me here…

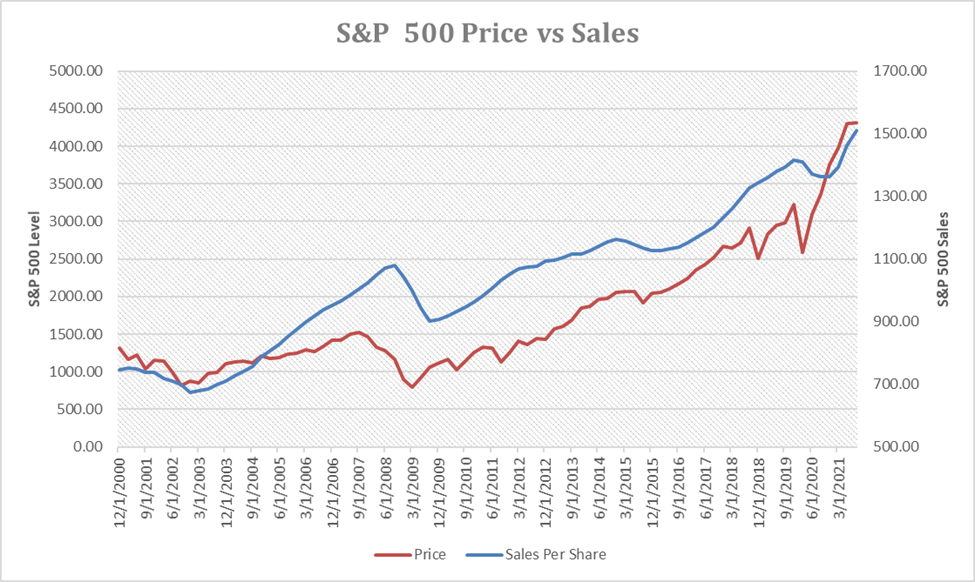

In our flagship investment research product we invest in stocks for the long-haul. What that means is we identify companies, at early stages, that have the potential to grow revenues and earnings by leaps and bounds over the next several years, on the simple data-backed thesis that stock prices follow revenues and earnings.

See the chart below, which illustrates the strong positive correlation between S&P 500 price and sales. Numerically, this is a positive correlation of 0.88, or nearly perfectly correlated. You don’t get much more closely correlated than that in the real world.

Regardless of a recession, solid growth companies will continue to grow their revenues and earnings at a very healthy rate over the next several years.

In other words, their “blue lines” from the above chart will continue to move up and to the right. Eventually, their “red lines” – or their stock prices – will follow suit.

That’s why we’re very bullish on growth stocks today.

Their blue lines (revenues) continue to go higher and higher, while their red lines (stock prices) are dropping sharply. This is an irrational divergence that emerges about once a decade during times of economic crisis, and it always resolves in a rapid convergence wherein the stock prices rally to catch the revenues.

Opportunity in Growth Stocks

Yes. A recession may be coming. Not likely. But certainly possible.

However, that doesn’t mean it’s time to “freak out.”

Remember: Crises create opportunities. In the markets, this has been the case forever. This time is not different.

And, in the current crisis, the opportunity is particularly large in growth stocks. We fully believe that, once this crash passes – as all crashes before it have – certain growth stocks will rattle off 100%, 200%, and even 300%-plus gains in matter of 12 months or less.

Originally published on InvestorPlace.com

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Leave a Comment