According to the GuruFocus All-in-One Screener as of Oct. 26, the following defensive stocks are popular among gurus.

Defensive Stock #1: Campbell Soup

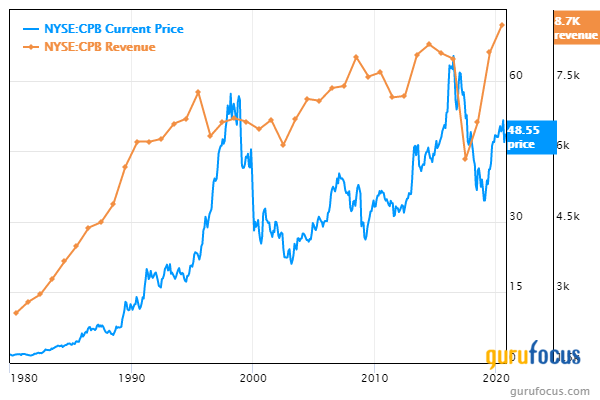

Campbell Soup Co. (CPB) has a market cap of $14.68 billion. Its revenue has increased 0.20% over the past 10 years.

The company, which provides branded convenience food products, is held by nine gurus, including Jim Simons (Trades, Portfolio)’ Renaissance Technologies with 0.95% of outstanding shares, Pioneer Investments (Trades, Portfolio) with 0.12% and Mario Gabelli (Trades, Portfolio)’s GAMCO Investors with 0.10%.

As of Oct. 26, the stock was trading with a price-book ratio of 9.08. The share price of $48.55 was 15.62% below the 52-week high and 19.29% above the 52-week low. Year to date, the stock price has declined 1.76%.

Defensive Stock #2: Boston Beer

Boston Beer Co. Inc. (SAM) has a market cap of $13.36 billion. Its revenue has grown 10.80% over the past five years.

Among the seven gurus invested in the U.S. high-end malt beverages company, Simons’ firm is the largest shareholder with 3.96% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 1.21% and Louis Moore Bacon (Trades, Portfolio) with 0.38%.

As of Oct. 26, the stock was trading with a price-earnings ratio of 97.95. The share price of $1091 was 0.16% below the 52-week high and 276.22% above the 52-week low. Year to date, the stock price has climbed 188%.

Defensive Stock #3: JM Smucker

JM Smucker Co. (SJM) has a market cap of $13.18 billion. Its revenue has increased 5.80% over the past decade.

The packaged food company is held by eight gurus. The largest guru shareholder is Simons’ firm with 1.22% of outstanding shares. Other notable shareholders include John Rogers (Trades, Portfolio) with 0.94% and Pioneer Investments (Trades, Portfolio) with 0.28%.

As of Oct. 26, shares were trading with a price-earnings ratio of 15.39, The share price of $115.54 was 8.02% below the 52-week high and 25.75% above the 52-week low. Year to date, the stock has gained 10.96%.

Defensive Stock #4: Chegg

Chegg Inc. (CHGG) has a market cap of $11.15 billion.

A total of seven gurus hold the stock. With 2.53% of outstanding shares, PRIMECAP Management (Trades, Portfolio) is the largest guru shareholder, followed by Frank Sands (Trades, Portfolio) with 0.70% and Pioneer Investments (Trades, Portfolio) with 0.65%.

On Oct. 26, the stock traded with a price-book ratio of 21.63. The share price of $86.76 was 3.41% below the 52-week high and 235.11% above the 52-week low. Since October 2010, the stock has climbed 128%.

Leave a Comment