We need to talk about a mistake almost every investor makes — and it’s a particularly easy trap to fall into today.

That would be letting the headlines push us to make investing decisions out of fear. Below, we’re going to dive into a scenario where doing so could have resulted in 30% in losses and missed profits in the last 12 months. And that’s before we even consider the dividends that would have been left on the table.

Inflation Fears Could Cost You Big

Let’s consider today’s inflation scare, which feels new, but in fact was just starting to make the news a year ago. Back then, many people sold out of (or at least cut back) their stock exposure, worrying that rising prices would prompt the Federal Reserve to get aggressive with rates, cutting the legs out from under the stock market in the process.

Imagine back in early 2021, our hypothetical investor gave in to these fears and went to cash. Even with the rough start the market has seen in 2022, they would have missed out on a nice gain.

The First Casualty of Panic Selling: Stock Market Gains

And this is just from the index itself. If our investor was overrepresented in some of the largest companies in the S&P 500 (or if they held one of our CEF Insider equity-fund holdings that focuses on these names, like one I’ll discuss in a moment), they would have likely missed out further: Apple Inc. (Nasdaq: AAPL), Amazon.com Inc. (Nasdaq: AMZN), Microsoft Corp. (Nasdaq: MSFT), Alphabet Inc. (Nasdaq: GOOGL) and Tesla Inc. (Nasdaq: TSLA),for example, had an average 22% gain from the start of 2021.

Then there’s actual inflation to consider. In February, prices rose 7.9% year over year. So if our panic-seller went to cash in January 2021, their holding would be worth 7% less today because of rising prices. So in addition to missing out on 15% or 22% in gains, they also missed out because their cash would now be worth over 7% less than it was a year ago.

That means up to 30% in lost money by selling because of inflation, not including any missed dividends! (Our dividends are a big reason why we CEF Insider members stay invested through market calamities — our portfolio’s equity funds yield an outsized 9.6%, on average, as I write this. That lets us hold tight and collect our payouts until the storm passes.)

So-Called “Inflation Hedges” Fall Flat

Instead of going to cash, inflation often prompts investors to go with a popular inflation hedge, TIPS bonds, instead. (TIPS, or Treasury inflation-protected securities,” are a type of government bond directly linked to inflation.) Essentially, the federal government promises to pay you an interest rate that goes up when inflation goes up, so if prices rise, so will your income.

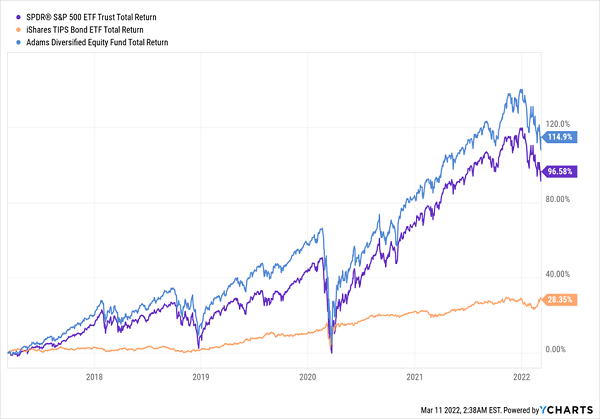

TIPS Gains Still Fail to Offset Inflation

Investors who exited stocks and went with TIPS instead ended up missing out on $1,071 per $10,000 invested. So switching to TIPS to protect your funds from inflation was better than going all cash — but worse than sticking to stocks and, in particular, top performers held by our CEF Insider portfolio.

Your Best Move: Grab 7%-plus Dividends With a CEF

As we noted above, the bulk of the gains in the S&P 500 have been focused on a smaller number of big movers that have put on strong gains in the last year. And now, these same stocks have pulled back a little with the rest of the market, giving us a nice entry point.

And of course, CEF fans that we are, we know we can get these stocks at a nice “double discount” when we buy through our favorite funds!

Take, for instance, the Adams Diversified Equity Fund (NYSE: ADX),a long-time CEF Insider holding. Its four biggest investments are four of the five largest companies in the S&P 500 (Tesla is the odd one out, but it does make an appearance as the fund’s 18th-biggest investment). ADX’s other top-10 holdings are blue chip U.S. companies with strong track records, including UnitedHealth Group Inc. (NYSE: UNH), NVIDIA Corp. (Nasdaq: NVDA), Bank of America Corp. (NYSE: BAC) and Berkshire Hathaway (NYSE: BRK.B).

These stocks have pushed ADX (in blue in the chart below) to a solid run over the last decade, easily eclipsing the S&P 500 (in purple) and massively outperforming TIPS.

My Tip? Avoid TIPS

ADX trades at a 14% discount to net asset value (NAV), meaning we can buy all of these great companies for 86 cents on the dollar. And when investors realize that ADX has crushed the market while paying at least a 7% dividend yield in each of the last five years, that discount is bound to disappear, giving us more profits on top of this fund’s already-strong portfolio performance.

Originally published on MoneyAndMarkets.com

Leave a Comment