So I don’t like to work very hard anymore.

Don’t get me wrong: I will still grind it out past the closing bell when I’ve zeroed in something important. And no weekend passes that I don’t do a little digging to get more actionable insight on a trend that looks promising or a sector that may be breaking out.

But, ya know, I hardly consider that kind of thing “working hard.” It’s more like satisfying my natural curiosity. And when I dig up a money-making opportunity that I can then share with my readers, well, I like that.

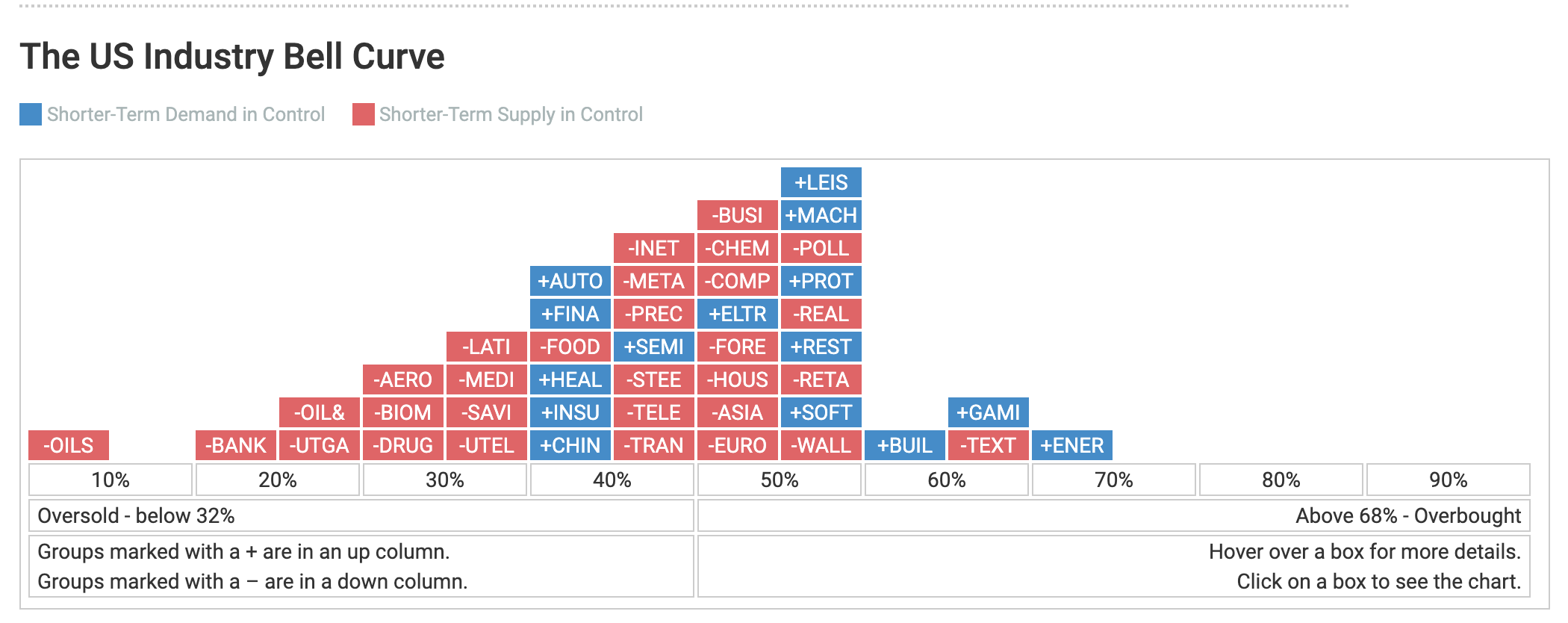

I’ve started using what amounts to a sector heat map to give me a quick and succinct visual of which stocks are showing solid buying interest. It looks like this:

Now, this heat map changes daily based on a variety of metrics. But the cool thing is that you can stack the daily maps, scroll them, and you get a moving picture like those stick-figure animations that you may have drawn on the corners of pages in a book when you were a kid.

Note the blue block labeled SEMIS. Two weeks ago, when stocks were still selling off, that SEMIS block was among the first to turn blue and start moving to the right.

Based on that movement, I recommended some Advanced Micro Devices (NASDAQ: AMD) call options to my Real Income Trader members last week. Those calls have just about doubled. And for the record, my partner at The Wealth Advisory, Jason Williams, coattailed us in that trade and took his 110% gain last week…

However, that’s not my topic for today. My interest right now is piqued by that sad red block sitting all by itself at the far left of the graph.

Divested to Death

Nobody wants to hang out with OILS anymore. “OILS is dirty,” they say as if it doesn’t bathe enough. Oil is a finite resource. Then there’s the carbon footprint… nobody really knows how to tabulate the carbon bill, though ExxonMobil shareholders have demanded the company start accounting for its liability. Many other investors skip the hassle and simply avoid fossil fuel stocks altogether. Like Norway’s sovereign wealth fund. One of the biggest in the world, it is divesting of the very thing that created it in the first place: oil and gas stocks. It’s a fascinating irony.

Now, you see that blue block labeled ENER all the way to the right? That is alternative energy. It’s doing pretty good and has been basically all year.

I’m gonna propose a bit of a different way of thinking about oil and alternative energy investing. Let’s say you had the loot to start a company today and you wanted it to be something that your kids could inherit and run in a few years. Chances are pretty good you’d choose something in the alternative energy space over traditional oil and gas drilling.

For starters, doesn’t alt energy just seem like less of a hassle? No drilling rights, less geographic limitations, fewer permits needed…

And if you simply look at penetration and usage rates, it sure seems like there are better growth prospects for alt energy.

Finally, and perhaps best of all, you’ll get fewer sidelong glances at dinner parties (you remember dinner parties, don’t ya?) if you sell gizmos for wind turbines.

Look, I’ve hammered on oil stocks plenty. My Wealth Advisory swore them off a couple of years ago. I’ve called oil stocks “uninvestable.” And I sincerely believe they should not be in any long-term portfolio — and by long-term, I mean something like five years or more. Basically, I have a hard time imagining that ExxonMobil will be selling more oil in five years than it is now.

I think — and I’ve written this before — the world is at peak oil demand right now. Whether it’s last year or next year or the year after, we are seeing the peak for oil demand. And the formula is pretty simple. Cars drive oil demand. Emerging markets, especially China, drive global car sales growth. Virtually all new car sales growth in China is coming from electric vehicles. It ain’t rocket science.

Are You the Keymaster?

Now with all that said, I have to acknowledge that the weakness in oil stocks is kind of a self-fulfilling prophecy. That is, it seems to me that many investors prefer alt energy simply because the growth looks better. That doesn’t mean the world is simply going to stop using oil.

And frankly, if you look at depletion and replacement numbers for oil, you can make a pretty convincing argument that there is an upside for oil prices. There have been more oil bankruptcies this year than during the financial crisis. Baker Hughes says there 266 active drilling rigs in the U.S. That’s down 589 from this time last year. Seems like a lot…

The world needs to add roughly 6–7 million barrels of daily supply to offset average well depletion. And with exploration and drilling way down, there is definitely a point where the current oversupply gets alleviated. I can even imagine a point where we even see a supply deficit.

Of course, I’m not talking about owning oil stocks until there is solid evidence that the oil oversupply is waning. The goal of a swing trader is simply to own the stocks as sentiment and price swing like a pendulum. I think we are at a point where the oil stock pendulum might swing bullish. And yeah, part of that is how much more negative can it get?

The key is economic growth. If recovery expectations continue to improve, it is inevitable that investors will start to fantasize about better demand numbers. And with a group of stocks this oversold, it could get explosive.

Apache (NASDAQ: APA), with a ~$4 billion market cap, is currently trading for less than its $5 billion in revenue. At $9.75 a share, its 50-day moving average is up at $13.50. That’s 38% right there. Two months ago, it was up around $16, or 67% higher than it is right now.

Just thought you’d like to know…

Leave a Comment