Verizon Communications (VZ) is primarily a wireless business as that segment represents the majority of revenue, and an even larger portion of operating income.

It serves about 92 million postpaid and 24 million prepaid phone customers and connects another 25 million data mobile devices such as tablets through a nationwide network. Verizon is the largest U.S. wireless carrier, putting it ahead of T-Mobile (TMUS) and AT&T (T).

In 2021, the firm agreed to acquire Tracfone, a wireless reseller that serves over 21 million prepaid customers in the U.S. The deal was closed in November 2021.

Fixed-line telecom operations for the company include local networks, primarily in the Northeast, which reach about 25 million homes and businesses, and nationwide enterprise services. Verizon Media Group, the online media and advertising firm formed with the acquisitions of AOL and Yahoo, was divested in 2021.

I am bullish on VZ stock as I believe that despite being a low-growth business, the essential nature of wireless communications will provide steady cash flow that can create shareholder value over time.

Q4 2021 Results

The company added 558,000 net postpaid wireless phone customers during Q4 2021, which was below those figures reported by AT&T (880,000) and T-Mobile (844,000).

Verizon still expects to post at least 3% Wireless Service revenue growth in 2022 and 9%-10% if you include the acquisition of Tracfone. The company has been successful at moving customers to higher priced premium plans.

Total revenues for Fiscal Year 2021 increased 4.1%, while Wireless Service revenues increased 4.7%. Adjusted EBITDA for Q4 was $11.8 billion, which was a margin of 34.5%.

Cash flow metrics for the year were strong, with operating cash flow of $39.5 billion. However, the telecommunications industry is a capital intensive business and capital expenditures totaled $20.3 billion for the year. That still left free cash flow of over $19 billion, of which $10.4 billion went to dividend payments.

Balance Sheet

Verizon has one of the largest debt loads of any company in the U.S., with total debt outstanding of almost $151 billion and cash and equivalents of $2.9 billion.

However, due to the company’s prodigious cash flow generation, the net leverage ratio is at 2.8x and it has investment grade ratings from Moodys and Standard & Poors with Positive outlooks from both.

Valuation, Dividend

Analyst estimates for 2022 and 2023 EPS are $5.48 and $5.62, respectively. Those low forward P/E’s of 9.7x and 9.5x are not too unusual for a low-growth company such as Verizon, but are still below historical averages which have typically been in the 11-13x range.

Fiscal Year 2022 guidance provided by the company recently called for Service revenue growth of approximately 3% (excluding acquisitions and divestitures) and adjusted EBITDA growth of 2-3% as reported.

Capital expenditures are expected to be approximately $17 billion, which means free cash flow should increase well over 2021 levels.

The company raised its dividend in 2021 for the 15th consecutive year. Currently the annual dividend stands at $2.56 which equates to a 4.8% dividend yield.

Wall Street’s Take

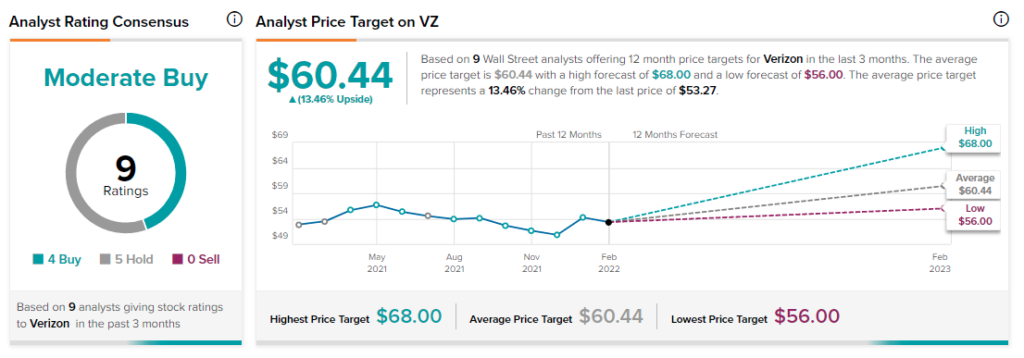

Turning to Wall Street, VZ has a Moderate Buy consensus rating based on four Buy ratings, five Hold ratings, and no Sell ratings assigned in the past three months. At $60.44, the average Verizon price target implies 13.5% upside potential.

Conclusion

I am bullish on VZ stock as I believe the high dividend yield combined with mid-single digit earnings growth will provide attractive relative returns going forward.

The low P/E and high dividend yield should provide some downside protection in a market downturn or recession, as consumer’s wireless activity has become an essential, or non-cyclical, expense.

Originally published on TipRanks.com

Leave a Comment