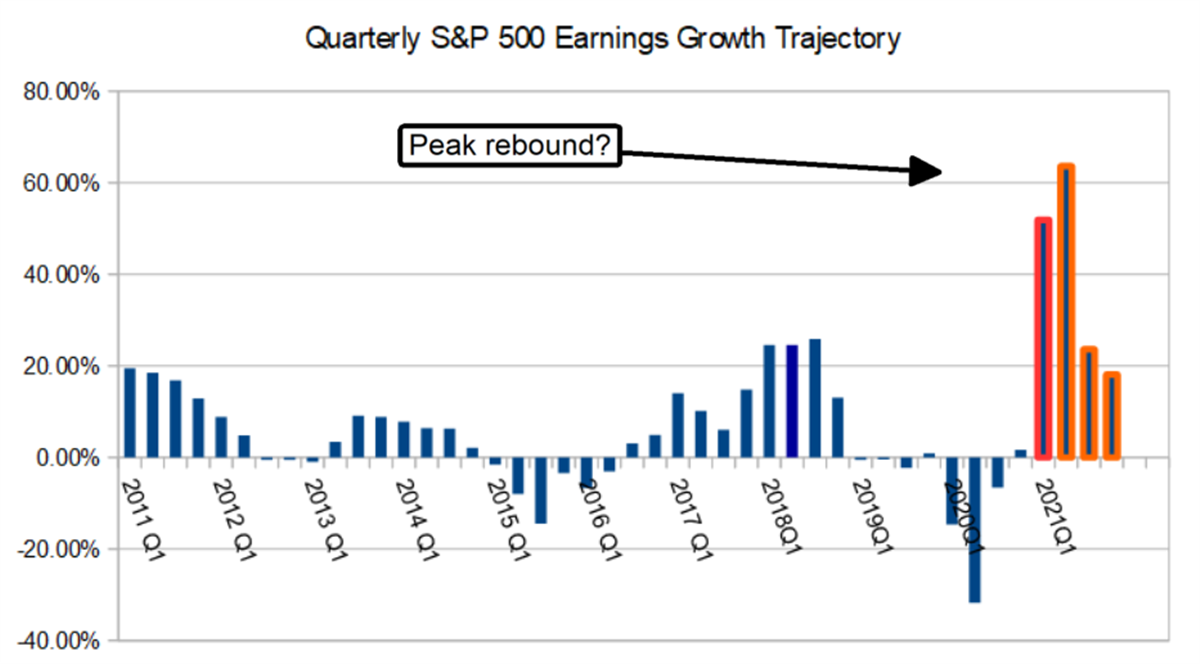

With the S&P 500 (NYSEARCA: SPY) second-quarter earnings cycle already underway now is a good time to get a grip on what to expect during peak season. So far 18 S&P 500 companies have reported their earnings with 15 of them outpacing the analyst consensus. To date, there are nine sectors with higher EPS expectations than at the beginning of the quarter and those expectations are still on the rise. Data released by Factset reveals the pace of earnings revisions has hit a crescendo and points to the second-highest level of quarterly earnings growth on record. But that may not be a good thing for the market because it’s been largely expected.

The Earnings Rebound Is Better Than Expected

The earnings rebound is better than expected but really, that’s only in relation to the analyst estimates. The analyst community as a whole has been slow to catch up with the pace of earnings growth in the wake of the pandemic so the real question is how much better than expected will earnings be? Right now the consensus is for S&P 500 earnings growth to top 63%, the risk for the market is that results will not surprise enough to keep the bulls interested in light of a drastic slowdown in the second half. While the trajectory of earnings growth will remain positive, the pace of growth will slow drastically in the second half with many S&P 500 sectors expected to post year-over-year earnings growth declines.

Trading at 21.5 times its forward earnings, the S&P 500 is very highly valued and this puts it at risk for a correction. What the market needs to see in the earnings reporting is for momentum to be building, margins to be stable or widening, and for the outlook for calendar Q3 and Q4 earnings to be positive in relation to the current outlook. Because the consensus for the third quarter and fourth quarter are still on the rise, we think the market will need to see a significant uptick in the pace of earnings growth revisions for the second half.

Where To Look For Sector Strength

The strongest sector in the first-quarter reporting cycle was the Consumer Discretionary (NYSEARCA: XLY) sector. The group grew earnings by nearly 240% and is expected to lead again in the second quarter. The difference is that in the second quarter consumer-discretionary is expected to be the second strongest growing sector with the Industrials (NYSEARCA: XLI) leading. Earnings growth is expected to top 348% for the industrial group with the consumer discretionary group growing 205% and both of these sectors have seen strong upward revisions over the past quarter. In terms of revisions, both sector’s earnings growth consensus is more than 100% higher than it was when the reporting period began and still rising.

The 2 sleeper sectors that we are watching are the Materials (NYSEARCA: XLB) sector and the Energy sector. The Energy sector (NYSEARCA: XLE) produced solid double-digit year-over-year earnings growth in the first quarter due to the fact oil prices are at multi-year highs. There is still no estimate for revenue or earnings growth in the energy patch but we are expecting to see triple-digit year-over-year growth, improved cash flow, and dividend increases out of the group. The materials sector made it to our watch list because it has seen significant upward revision as well, upward revisions supported by economic opening and plans for infrastructure spending.

The Technical Outlook: Overbought Going Into Peak Season

Full story on MarketBeat.com

Leave a Comment