The home-cooking niche continues to heat up. McCormick (NYSE:MKC), a leader in the spices, flavorings, and condiments industry, announced surprisingly strong sales growth on Tuesday to kick off its fiscal 2021. Better yet, this Dividend Aristocrat raised its outlook on both earnings and sales, implying market-thumping returns for investors ahead.

Beating expectations

Investors had left McCormick’s stock out of the broader market’s rally of the last six months, yet the company made a good case for a change in that trend. In its fiscal first quarter, which ended Feb. 28, sales rose 20% year over year — well above both Wall Street’s targets and the 5% uptick the company notched in the prior quarter.

“We started the year with outstanding performance,” CEO Lawrence Kurzius said in a press release.

Looking beyond the headline sales number, demand trends were impressive. McCormick’s consumer segment continued to benefit from the increased share of meals being prepared at home, and from the addition of the newly acquired Cholula hot sauce franchise. Demand was especially strong in China, which bounced back from a pandemic-related sales plunge a year ago. McCormick also notched modest growth in its restaurant division even though people are eating out less often due to COVID-19.

Cash and profits

McCormick’s already strong finances improved in the period. Gross profit margin rose by 0.6 percentage points thanks to higher prices and cost cuts. Reduced spending in other areas of the business amplified these gains so that adjusted operating income jumped 32% year over year.

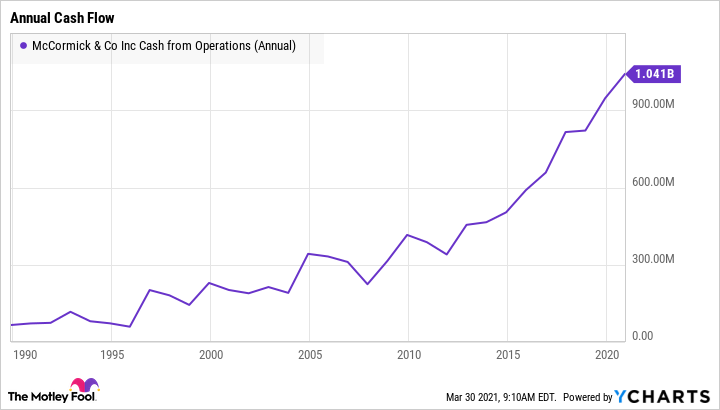

Cash flow turned slightly negative in fiscal Q1, but management said the decline was entirely due to the timing of some inventory payments. Executives affirmed their outlook for another solid year of cash generation after McCormick’s annual cash flow passed $1 billion for the first time in fiscal 2020.

That cash spike is funding more investments in the business, and it also helping McCormick pay down debt while increasing its cash returns to shareholders. The company late last year announced a 10% increase to its dividend payment — its 35th consecutive annual raise.

“The investments we made in our supply chain resiliency and brand marketing,” Kurzius said, “provide a foundation for growth while enhancing our agility and our relevance with our consumers and our customers.”

A spicier outlook

McCormick raised its outlook just three months after issuing some bold predictions about 2021. Management still anticipates a fundamentally higher pace of growth in the home-cooking industry even as vaccines reduce the coronavirus threat. But that boost should be more favorable and will occur even as the restaurant segment continues rebounding.

Full story on Fool.com

Leave a Comment